Nysa EB-5 Immigrant Investor Program

A Leader in EB-5 Investing

Since 2014, Nysa EB-5 has been a recognized leader in the immigrant investor space, providing thought leadership to streamline processes and establishing standards that are now being adopted as industry best practices. We are leading the way in bringing EB-5 projects that reduce risk and help investors receive a U.S. green card.

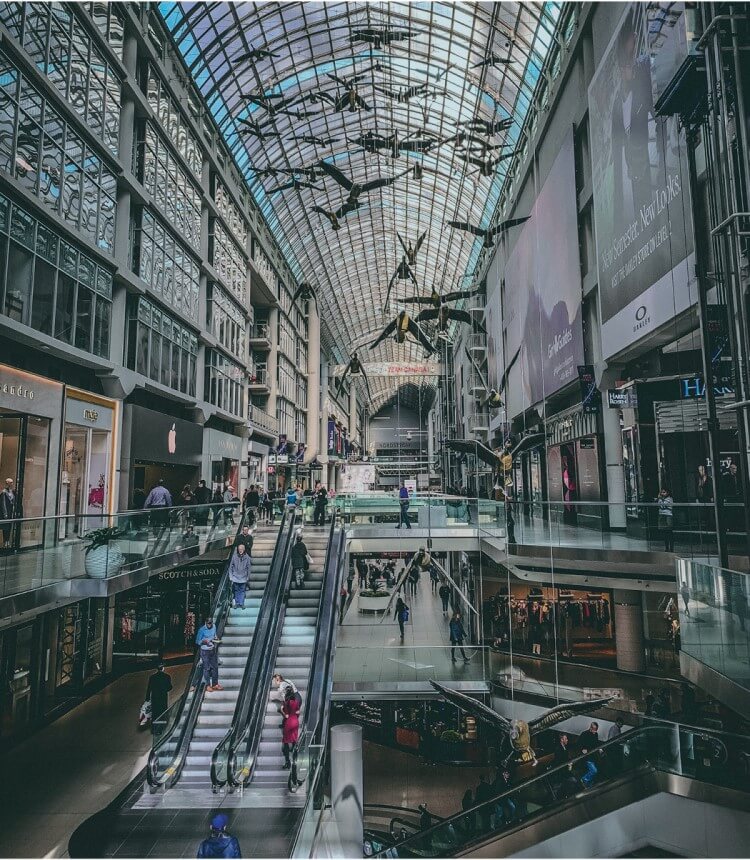

High-Quality Projects

Our mission is to select high-quality projects that deliver maximum value for our EB-5 investors. We have a rigorous project selection process and partner with best-in-class firms to enhance our ability to safeguard the transactional integrity of each EB-5 project.

Current Projects

Casa Grande, Arizona

Elementé Casa Grande

Orlando, Florida

Church Street Station

About Nysa EB-5

consecturer quiam ipsam expereiciis dinso hem

Nysa EB-5, LLC is a division of Nysa Capital, LLC, a full-service merchant banking and financial advisory firm based in Atlanta, Georgia USA. We specialize in EB-5-structured project financing and operate with an investor-centric, compliance-oriented service delivery model. As an independent EB-5 service provider, Nysa EB-5 is not limited to projects in any specific geographic location or to partnering with any single regional center. We have the flexibility to look at many projects and select only the best ones. Our strenuous screening process and our demanding high standards ensure that every project we offer exceeds the goals of the EB-5 program.

“The EB-5 Program, when structured within Nysa EB-5’s institutionally oriented framework, not only fuels economic growth and job creation but also provides a secure and strategic pathway for global investors to participate in the American Dream, ensuring both financial return and community impact.”

– Hon. George H. Foresman

Chairman of the Board, Nysa EB-5

Former U.S. Undersecretary of Homeland Security

News

Article 3

Article 2